Building elder care for the future

AgeTech is a burgeoning industry. How are we planning to care for the explosion in older adults in the U.S.?

Hey everyone, Happy New Year!

Thanks for being a subscriber to my newsletter. After five years of doing the podcast, I’ve done a bit of thinking and want to write more this year. I’ll be trying to send a more frequent newsletter with a focus on health services in the United States. I’ll be trying to unearth interesting changing tides in HealthTech and the healthcare industry. If you reply to this post, I’d love to hear your thoughts about this post but also the direction of the newsletter generally!

Introduction

Healthcare is a multi-trillion dollar industry—and the population that we’re caring for is changing. Last year, I wrote an article about the coming silver tsunami—the idea that we have an aging population, and it will expose various cracks in an already tenuous health services sector.

As I look forward, I think this problem is going to get worse. In 2030, every Baby Boomer will be above 65 and 1 in 5 Americans will be of retirement age. This reflects a problem: as patients grow older, their functionality and mobility decline, creating cognitive and physical issues.

However, I’m not just predicting doom and gloom in the future. I think that healthtech has an outsized opportunity to address this issue in a meaningful way, partly because health services are hard to scale due to the labor costs involved in providing care and apps provide a way to productize a service. Moving from care services to apps focused on leveraging care at home, however, is difficult because it requires some thought about how to best design and create apps for an aging population (i.e., larger fonts, better explanations of features). Even further, financially, the North American aging marketplace is poised to grow at a CAGR of 6.8% between 2022 and 2030, allowing new entrants to try to capture that growth through service commodification.

As aging-in-place becomes a larger part of the home, digital health companies can use various market drivers to their advantage, which can accelerate adoption of digital tools across the patient, payer, and provider spectrum. Across the spectrum of care, from home-based therapies to those enabling provider services, AgeTech is now being focused on how to keep seniors at home, rather than making them come into the nursing home, skilled nursing facility (SNF), long term acute care hospital (LTACH), or inpatient care. Preventative care is getting the focus that it needs, especially as payer utilization management inquiries grow.

Table of Contents

Drivers for the AgeTech Market

A greater ability for individual patients to age with dignity. As shown by the Golden Bachelor’s popularity (the show’s September premiere delivered the highest ratings in years with a combined 13.9 million viewers), Baby Boomers are ready to partake in an aging experience which preserves their dignity and independence. In a report from the U.S. News, 88% of seniors reported that assistive or health-related technologies have improved their quality of life. Seniors will be looking for tools to help them increase their ability to perform their activities of daily living (ADLs), particularly health-related or service-related apps. In fact, during the COVID-19 pandemic, Instacart reported that seniors showed the largest jump in usage compared to all other age groups.

Increased need for long-term care innovation. CMS programs such as the program of all-inclusive care for the elderly (PACE) are leading the charge for aging-in-place. Furthermore, Medicare Advantage (MA) plans have introduced “targeted” and “chronic” benefits to help seniors to perform their ADLs and provide transportation to their medical care and social activities. However, PACE centers are stymied by federal and state regulation, and while there are some centers which are using AgeTech (i.e., WellBe Health), the regulation presents hurdles for the program’s expansion. Furthermore, there are gaps in Medicare Advantage Care, which doesn’t provide personalization of the care to the patient. As the elderly population grows, payers and providers will need more sophisticated measures for managing population health to spread risk and manage utilization across various levels of care acuity.

A shrinking caregiver population. Unpaid caregivers are individuals involved in assisting others with ADLs or medical tasks. In 2018, more than one-in-ten U.S. parents were also caring for an adult. These caregivers, part of the “sandwich generation,” find it hard to pay for the cost of care, especially because 70% of the market is reimbursed out-of-pocket. Further complicating matters, this unpaid care can eat into caregivers’ working time, preventing advancement in their professional lives as well. Currently in their forties, this millennial population is trying to balance seniors’ desire to age-in-place, the rising cost of elderly care, their children, and their own lives, creating a tenuous situation. Caregivers need solutions to help manage their parents’ health and ADLs while also preventing burnout, but also to support their own mental health and wellbeing.

A more engaged patient population. The share of U.S. adults who are 65 and older who are tech users has grown in the past decade, and over 60% of people who are over 65 are using a smartphone. In addition, 45% of people over 65 use social media. These statistics indicate that the narrative that older adults don’t want to use technology is largely false, and ushers in the possibility for digital tools to learn new skills online through videos which teach new skills and information—in fact, YouTube is the most popular social media platform for elder folk, with about half of adults over 65 using it.

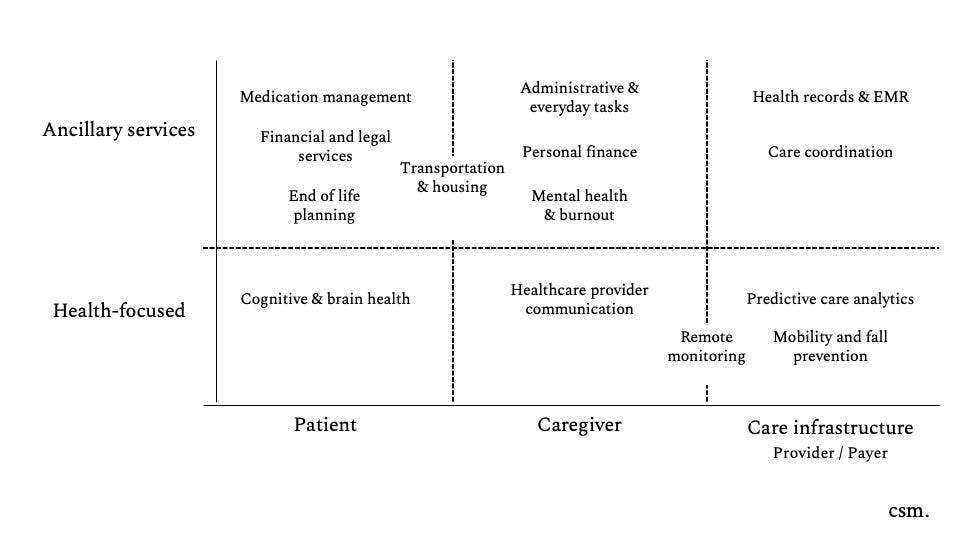

Segmenting the AgeTech market

Aging in place requires an empowered patient, supported by a present and engaged caregiver, but also requires responsive providers. The main pain point in the market, I believe, is standing up a robust services infrastructure to provide care to seniors when unpaid caregivers cannot pick up the slack. These providers need to be given the right information to care for seniors who likely have different care needs and abilities to ensure a personalized model of care.

Medication management

I have less than 5 medications to manage, and yet I still have difficulty remembering whether I take them every day. I can just imagine if I had twenty medications, each of them with complex names, with different frequencies, and I had to track them perfectly, day after day. Startups such as Omnicell, Healthprize technologies, and WatchRx all have unique methods for patient adherence, targeting providers, payers, or patients to ensure that they know how and when to take their medications.

Patient engagement regimens are important, but I think the greatest leverage startups in this space are pursuing health literacy, specifically regarding patient adherence to their medication. For example, SpeechMed and Polyglot Systems (acquired in 2017 by FDB) provide easy to understand medication instructions for elderly patients. I think that innovative startups in this area in the next few years are going to use artificial intelligence to provide easy-to-understand instructions for patients and caregivers.

End of life planning

End of life planning is a big part of the aging in place market, because most people want to die at home. However, it’s not always what it is cracked up to be—home hospice, while being the most profitable beneficiary of Medicare, is often a burden for caregivers. After death, patients can’t find time to grieve without being harassed with unpaid credit card bills or trying to settle an estate. Startups like Empathy, Cake, EverPlans are trying to simplify the process for managing these documents to have a better experience for patients after their loved ones pass. Furthermore, FreeWill, Willful (Canada), and Farewill (UK) provide services for patients to create wills online so that it’s easier for patients to create their wills online in the comfort of their own homes.

I’m more bullish about this category, not only because it provides a better use case for patients, but it allows for greater convenience for unpaid caregivers after their loved ones pass. Instead of worrying about the credit card bills and random passwords for your late father’s LinkedIn, you can focus on the grieving process.

Cognitive & brain health

Cognitive and brain health encompasses a huge market, and it’s great that there are so many startups trying to target this issue.

First, Americans older than 60 are alone for half their daily measured time, and loneliness is a big issue for seniors. Loneliness is linked to not only various mental health diseases, including depression, but also physical health diseases, increasing weight gain, sleep deprivation, poor heart health, and a weakened immune system. This is why software-enabled solutions like Altoida, Neurotrack, Duos, Rippl, and Hank are tracking brain health for the elderly and providing age-appropriate social outlets for this population. In fact, Amazon is even partnering with academic institutions to combat these issues, using Alexa to help older adults suffering pain to avoid loneliness and isolation.

These startups have the potential to also track cognitive fitness and predict the slow (or quick) transition to dementia and loss of ADLs. I’m curious about how many seniors actually use their services, considering that they are probably either D2C or B2B to payers rather than providers recommending these apps. Furthermore, without a robust provider / caregiver / senior network to connect with other seniors, it’s hard to imagine that these apps can scale.

Mobility & fall prevention

One of the biggest MSK issues which pops up in older age is the loss of stability. Therefore, fall prevention is of utmost importance, especially because they are the leading cause of death for adults aged 65 and older. Startups in this space include Hinge Health, Wizecare, Gait Better, Bold (movement-as-medicine), Selfit Medical, Mighty Health, and Element3Health. While these startups might find success selling to employers and payers, I think that the best bang for the buck is selling to providers specifically, as most people think of their provider when they’re thinking about maximizing their health.

Just check out the comments on this Reddit post about LifeAlert, and the very real outcome of losing mobility as we get older:

Furthermore, since this is a proactive tactic rather than a reactive one—you can only improve mobility if you haven’t lost it yet—it’s important to make sure that these startups are educating the right providers to recommend their services to seniors. Incentives drive action—the people who want to age healthily are already doing these behaviors. I can see these as part of the recommendations that an interdisciplinary team (IDT) makes for a dual-enrolled senior in a PACE center.

Remote patient monitoring

Software has the potential to help caregivers monitor seniors’ health, and communicate that to providers. Just like kids, they might forget to tell you important things that happened but has a great impact on their health. Startups like CareMobi, Qumea (fall prevention monitoring), Acorai (heart failure), Toi Labs (Toilet logging), Binah.ai, Somatix, and CarePredict provide digital sensors attached to physical objects to passively monitor vitals, health behaviors, and outcomes.

Most of these startups target nursing homes and providers, parlaying these outcomes to help providers monitor patients’ health and assess their health. Startups such as Mon4t and Together are taking tracking one step further, allowing patients to use their smartphone to act as a neurological laboratory and assess certain biomarkers through research protocols.

Largely, I think that this category of startups generate data which can then be amplified using a platform of predictive care analytics, and many are trying to do so. I see this as table stakes for any RPM solution of the future, and enables better patient safety monitoring and allows for moving away from fee-for-service constraints by prioritizing preventative medicine and incentivizing action before catastrophe (i.e., providing care before falls rather than after falls).

Transportation & Housing:

As we age, the environment around us poses difficulty. For example, consider your weekly trip to the grocery store or to the mall. For the elderly, there is a hurdle to overcome not only to physically get to the store, but also around trying to find the right goods for themselves. A huge portion of aging with dignity is dealing with the loss of independence in an empathetic manner.

For seniors, startups such as HopSkipDrive, Onward, SilverRide, and GoGoGrandparent allow for greater independence by offering services like rides, assistance with groceries, meals, prescriptions, and home services. As caregivers want greater autonomy while caring for the elderly, these startups may see greater adoption to maintain seniors’ independence while having the peace of mind that comes with having qualified, vetted drivers help with certain ADLs.

In addition, housing poses a similar conundrum too. What may have been easy activities for a 60-year-old—climbing stairs, bathing themselves, or walking across tile—may not be so easy for an 80-year old. This is where home modification startups like Rosarium Health, Jukebox, UpsideHoM can help. However, this goes further than just modifying the physical environment—startups such as Nesterly and Silvernest are creating social modifications by introducing intergenerational housing sharing agreements. Having a younger person or a peer can also help in cases where a senior falls down, where there is someone to help them and call for further support.

I’m excited to see how older adults react to the idea of having a roommate again, because it would challenge the notion that older people are resistant to change. I think that largely, home modification and transportation startups have a greater chance of succeeding, largely because they preserve the independence of an older adult rather than force them to adopt a new normal, perhaps with another person who they hadn’t met until now.

Caregiver-related apps

Administrative, communication, and mental health applications

Creating applications for caregivers is difficult because of the variety of use cases to target. Each caregiver’s situation is unique, but there are some common threads which companies have been trying to target: administrative concerns & communication with healthcare providers, and mental health and burnout.

Part of the difficulty of caring for an elderly parent is the organizational challenge of keeping everything straight: some of the considerations include choosing insurance benefits, keeping healthcare appointments, sorting out finances, and creating a plan for their continued health. Startups are trying to take different approaches to tackle these issues. One angle is to work with health plans to help administer aging benefits, and aid caregivers with a pleasant customer service experience (The Helper Bees). Another is to work with providers of aging benefits like State Units of Aging or Area Agencies for Aging to provide a more automated solution for strapped home health agencies (Mon Ami). Yet another approach includes helping the actual caregivers to manage all the different demands facing their attention (Ianacare, Wellthy).

However, while these startups streamline the administrative issues and communication with healthcare providers, burnout is another issue which startups are trying to solve, through care providers which meet with caregivers regularly (Cariloop, Homethrive) or through modules which train caregivers appropriately (Trualta, Careforth).

Hiring help when caregivers aren’t available

Most of the market for finding reliable, skilled home health aides is opaque and private pay. Because a vast majority of the market is out-of-pocket and unaffordable, it’s hard for families to find and pay for a home health aide. Even though the trends are changing and multi-generational families are becoming the norm in America, finding an unpaid caregiver when children are not available is still a struggle for seniors.

Startups like Honor Care, Papa, Naborforce, CareGuide, and Kinumi are trying to pair seniors with caregivers which can help with ADLs when their family is not around. This definitely has a tie in with combating loneliness, which is a crucial component of the cognitive & brain health as seniors get older—startups in this space, I believe, are vital for an integrated plan with at-risk seniors (see predictive care analytics). With any services market, there are risks associated with hiring contractors (see Papa’s recent Bloomberg profile on allegations of sexual harassment and assault) but I think that these relate to growing pains for an industry which is in dire need of innovation rather than a death knell.

Predictive Care Analytics

This is the most interesting area to get traction in recent months, with the advent of artificial intelligence in healthcare. I too think that this is the most interesting area of investment, because using the RPM and EHR data to monitor patient safety can help LTACHs, SNFs, and PACE centers achieve their quality outcomes to profit from capitation payments. Furthermore, they allow providers to offer the point solutions that digital startups often offer to health plans and home agencies and allow for the opportunities to see how they can bundle services for clients.

I largely believe that these startups fall into two groups, payer- and provider-related care analytics. On the payer-related side, Assured Allies and Trusty.care are helping payers reduce utilization management and revamp their sales funnel, creating increased bottom- and top-line growth. I think that as VBC and risk-adjusted care becomes more common, payers will have to ramp up their offerings via the other categories of AgeTech (Cognitive & brain health, mobility & fal prevention come to mind) to make sure that their members are being attended to at home before coming into a SNF or a LTACH.

As patients migrate to needing more coordination of care services, startups such as Intus Care and Clarent are catering to the provider-related care analytics to make sure that they are creating margin growth while taking on further risk through value-based contracts. As of writing this post, it seems like Intus Care is focusing on marketing to PACE centers IDTs, to identify at-risk members and automate case management, socialization, and medical coordination. Even further, if providers want to avail a Long Term Support Services network, startups like Dina Health to coordinate that care. Provider-related care analytics can also apply to the workforce—at a time when there is caregiver attrition, startups like Perry can increase the workforce retention through well-thought out incentives.

Real-time hypothesis testing (i.e., do digital health tools actually work for our at-risk population) is possible by having clear, actionable insights. I think that startups working in these categories, therefore, have the greatest leverage to usher in other factors of AgeTech, and the possibilities for using a digital-first strategy is endless. Using PACE for example, it’s easy to see how an IDP utilizing Intus Care can recommend that a immobilized, at-risk senior can use Instacart for food delivery, a personalized Hinge Health program, and a way to manage that care with an unpaid caregiver using one of the administrative tools which takes care of healthcare provider communication.

Conclusion

This is a lengthy post. Feel free to read all of it or only the parts which interest you—it’s been a very interesting exercise to develop my own investment theses about the different parts of the AgeTech market. I think that this area has already had great interest (see the New York Times’ recent piece on aging, specifically around entrepreneurship in aging), and will continue to gain traction as the USA wakes up to the idea that by 2034, there will be more adults over the age of 65 than children.

I think it’s important to become savvy about this area because of the various trends shaping the space and the increased need for innovation. Largely, we’ve treated old people like they’re invisible, like an afterthought. I’m hoping that this piece shows that investment into this space will continue to increase, and that hopefully we can identify these trends so that our parents and our loved ones can gracefully age in the comfort of their homes, with comfort and with dignity. I’m eager to see what the future holds for AgeTech, as this is only a starting point for the startups which are going to pop up in the future.